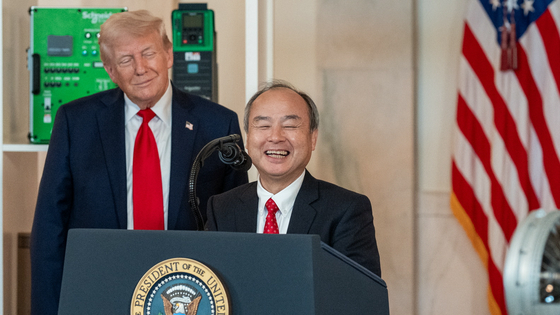

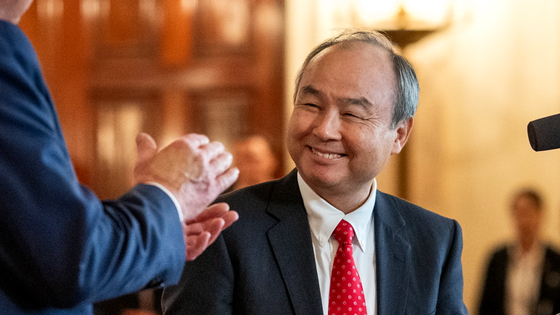

SoftBank CEO Masayoshi Son reportedly met with Intel CEO Lip Vu Tan weeks before announcing the $2 billion investment in Intel's foundry business.

Masayoshi Son, founder and CEO of SoftBank Group, has reportedly been in talks with Intel CEO Lip Vu Tan about acquiring the company's semiconductor foundry business. The meeting reportedly took place just weeks before SoftBank announced it would invest $2 billion (approximately 300 billion yen) in Intel shares.

SoftBank held talks with Intel on buying contract chipmaking business

SoftBank's growing bets on AI and semiconductor assets | Reuters

https://www.reuters.com/business/media-telecom/softbanks-growing-bets-ai-semiconductor-assets-2025-08-19/

On August 19, 2025, SoftBank and Intel officially announced that they had entered into a definitive agreement for SoftBank to invest $2 billion in Intel common stock.

SoftBank signs deal to invest $2 billion in Intel & Trump administration also in talks to acquire 10% of Intel shares - GIGAZINE

According to sources familiar with the matter, Son has been in talks with Tan since he took over as CEO in March 2025. The discussions come as Intel's foundry business struggles to compete with TSMC. Intel opened its foundry business to external customers in 2021, but has struggled to attract new customers.

The discussions were wide-ranging, and multiple options were considered, including a business acquisition, a joint venture with a third party, or a minority investment, as announced today. A source said, 'The announcement of this $2 billion investment does not preclude the possibility of a 'bigger deal' for the foundry business in the future.'

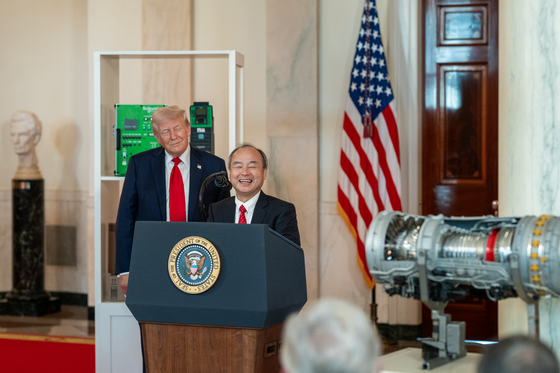

The US government has also shown interest in this move and is considering investing in Intel, which could further solidify the path for SoftBank to make additional investments.

Intel's foundry business is significant for Son, who has built a close relationship with President Donald Trump during his biweekly visits to the US. For the Trump administration, saving Intel is a way to maintain domestic advanced semiconductor production capacity in the US against TSMC's dominance, and for SoftBank, it is a key component of its ambitious plan to build a comprehensive AI infrastructure that includes robotics, energy, and semiconductor manufacturing.

In parallel with this investment, the US government is also moving to deepen its involvement in Intel. Secretary of Commerce Howard Lutnick

SoftBank's $2 billion investment represents approximately 2% of Intel's outstanding shares, making it the fifth-largest shareholder.

Related Posts:

in Note, Posted by log1i_yk