The CEO of China's largest semiconductor supplier says the industry is in a state of panic over memory shortages, suggesting that supplies may resume in the second half of 2026

With reports that

SMIC CEO Says Memory Chip Shortage Has Industry 'Panicked' - WSJ

https://www.wsj.com/tech/smic-ceo-says-industry-panicked-about-memory-supply-shortage-f0e1aaed

AI Boom Fuels DRAM Shortage and Price Surge - IEEE Spectrum

https://spectrum.ieee.org/dram-shortage

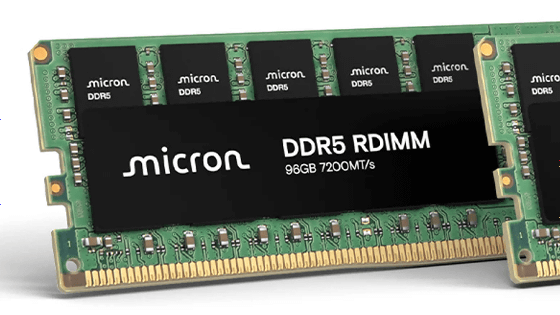

According to market research firm Counterpoint , memory prices are expected to rise by 80-90% between the end of 2025 and 2026 due to a surge in the price of DRAM used in servers.

In response to the surge in memory prices, Samsung forecasts sales of approximately 93 trillion won (approximately 10 trillion yen) and operating profit of approximately 20 trillion won (approximately 2 trillion yen) for the fourth quarter of 2025 (October to December), three times higher than the same period last year. While industry players attribute the rise in DRAM prices to demand for AI, some experts point out that it may also be the result of actual price manipulation.

Industry companies blame rising DRAM prices on AI demand, but some see price manipulation as a real problem.

SMIC CEO Zhao Junyi said in a conference call after the company's earnings announcement on February 11, 2026, 'The memory supply shortage may be exacerbated by overbookings by manufacturers desperate to secure essential components.' Zhao said, 'Everyone is a little panicked.'

According to Zhao, semiconductor suppliers like SMIC are seeing a decline in orders from mid-range smartphone makers. Even if they were to secure more memory by passing on the increased memory costs to consumers through price hikes, this would still lead to a decline in consumer demand, and sales would inevitably decline, Zhao said.

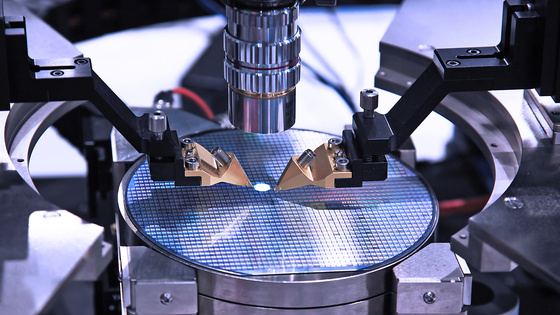

However, Zhao added that memory supply may increase within nine months. SMIC warned that memory chips for AI-related products, such as high-bandwidth memory, require a longer and more complex verification process, so 'when new memory is available, it may be prioritized for AI companies first,' and urged customers manufacturing electronic devices for consumer use not to be too pessimistic.

IEEE Spectrum, published by the Institute of Electronics Engineers (IEEE) , predicts that it will take years for memory supply to catch up with demand thanks to new production capacity and new technologies, but states that 'prices may remain high.' This is because approximately 70% of global memory production is expected to be consumed by data centers by 2026, and even though new factories and equipment are being built to increase memory supply capacity, these efforts will take years, making it difficult to improve in the short term. As long as memory demand continues to increase due to the race to develop AI, memory prices are unlikely to fall, the IEEE states.

Related Posts: