While industry companies are explaining that the rise in DRAM prices is due to 'demand for AI,' some believe that price manipulation is actually taking place.

DRAM , a type of volatile memory widely used in PCs, smartphones, data centers, and more, is experiencing a historic price surge in 2025. DRAM manufacturers blame the price hike on increased demand for AI, but Adam Conway, a writer for technology media and XDA Developers, is skeptical of this explanation.

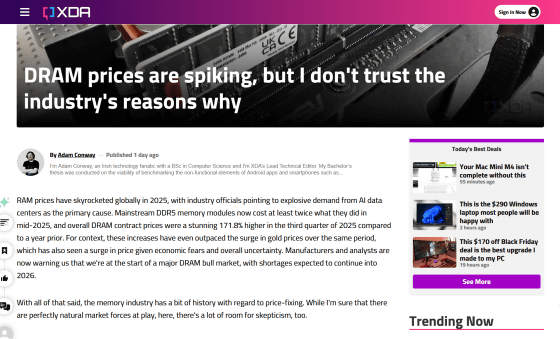

DRAM prices are spiking, but I don't trust the industry's reasons why

https://www.xda-developers.com/dram-prices-spiking-dont-trust-industry-reasons/

In 2025, wholesale and retail prices for server and PC memory are soaring, with a 32GB Corsair RAM kit, which cost $110 (approximately ¥17,000) in early 2025, now costing nearly four times as much at $442 (approximately ¥69,000) at the time of writing. The price increase isn't limited to DRAM; prices for NAND flash memory and HDDs are also rising in tandem, enough to offset the price declines for CPUs and GPUs.

Major PC manufacturers and system integrators have already begun stockpiling RAM to ensure supply, but ASUS has stated that it only has about two months' worth of inventory left for production. The Raspberry Pi Foundation has also been forced to raise the prices of its 4GB and 8GB models by $5 and $10, respectively, due to the significant increase in memory prices.

Even data centers are not immune to this situation, with some analysts estimating that the steep price hikes by Samsung, the world's largest memory manufacturer, could push up AI server costs for cloud providers by 10-25%. Furthermore, if inventory becomes completely unavailable, the rollout of AI data centers could be delayed.

Manufacturers blame rising DRAM prices and supply shortages on the growing demand for AI, which requires massive amounts of memory and storage. For example, OpenAI's Stargate infrastructure project recently signed major contracts with Samsung and SK Hynix to supply up to 900,000 DRAM wafers per month, equivalent to roughly 40% of global DRAM production.

Samsung and SK join OpenAI's AI infrastructure project 'Stargate' to 'make Korea one of the world's top three AI nations' - GIGAZINE

The global DRAM industry has seen boom and bust cycles over the past few decades, with competitors being driven out one after another. As of the time of writing, the industry is dominated by three companies: Samsung, SK Hynix, and Micron. Therefore, the strategic choices made by these three companies have a profound impact on supply.

Manufacturers cut production and investment during the 2022 recession, and subsequent recovery has been slow. Furthermore, given the uncertainty surrounding when the recent AI bubble will burst, manufacturers are unlikely to significantly increase DRAM production, due to the risk of market fluctuations. To make matters worse, manufacturers have shifted their investments from standard DRAM manufacturing to HBM manufacturing, as the High Bandwidth Memory (HBM) used in AI accelerator GPUs has achieved significantly higher prices and profit margins than commodity DRAM in recent years.

The industry explains that these factors are driving up DRAM prices and keeping up with supply. However, Conway points out that 'there have been cartels in the memory industry in the past that illegally fixed prices,' and suggests that even at the time of writing, manufacturers may still be intentionally inflating prices to some extent.

In the early 2000s, several manufacturers, including Samsung, SK Hynix, and Micron, pleaded guilty to conspiring to fix DRAM prices and were fined tens of billions of yen. In 2021, a class action lawsuit was filed against Samsung, SK Hynix, and Micron, alleging that they were manipulating DRAM prices.

Samsung, Micron, and SK Hynix face class action lawsuit for 'DRAM price manipulation' - GIGAZINE

This history shows that DRMA manufacturers have the incentive and precedent to adjust prices to keep them high. Even without a formal cartel, implicit price adjustments can occur if manufacturers agree that an oversupply in the market would hurt their profits.

'It's hard not to be cynical when we hear that 'AI demand' is the sole cause of rising prices, against the backdrop of past cartels,' Conway said. 'Whether or not there is current collusion, it's clear that memory companies are profiting enormously from the current crisis. Major DRAM manufacturers who were financially hit by the last oversupply recession are seeing record profits in the third quarter of 2025 thanks to rising prices, and frankly, this shortage is a great opportunity for business.'

Related Posts:

in Hardware, Posted by log1h_ik