Asahi Group's shipping volume has fallen to 10% of normal levels due to a cyber attack, leaving rival beer companies looking to grab market share.

On September 29, 2025, Asahi Group Holdings was hit by a cyber attack by the Russia-based cybercrime group

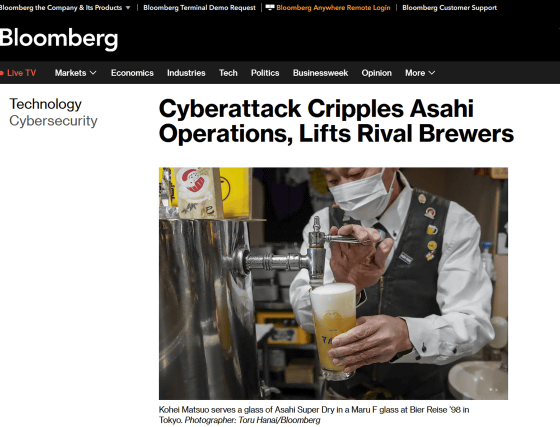

Cyberattack Leaves Asahi Struggling as Rival Brewers Gain Ground - Bloomberg

https://www.bloomberg.com/news/articles/2025-11-10/cyberattack-leaves-asahi-struggling-as-rival-brewers-gain-ground

Asahi Cyberattack Cripples Japan's Largest Brewer

https://thecyberexpress.com/asahi-cyberattack-japan-operations-crippled/

The Asahi Group was hit by a cyber attack by the ransomware group Qilin, which caused problems with order-taking, shipping, and call center operations at domestic group companies, forcing the suspension of operations at most of its domestic factories.

Ransomware group 'Qilin' claims responsibility for cyber attack on Asahi Group Holdings - GIGAZINE

According to Bloomberg, Asahi Group's internal system for processing orders and shipments has stopped functioning, forcing the company to switch to manual operations, including face-to-face, phone, and fax. An Asahi Group spokesperson said that shipments have fallen to 10% of normal levels as a result.

For the Asahi Group, whose core business is beer such as Super Dry , the decline in shipments is a major blow as December approaches, the end-of-year party season, which is usually Asahi's best month for sales.

In an interview with Bloomberg, Matsuo, who runs a beer hall called BIER REISE '98 in Shinbashi, Tokyo, said that while 80% of his sales used to come from Asahi Breweries' Maruef beer, he ran out of stock within a week of the cyberattack, forcing him to switch to other domestic and imported beers.

Iida, manager of the Ueno Ichiba Honten izakaya in Ueno, Tokyo, also said that he temporarily switched to Sapporo and Suntory beers before Super Dry stock resumed. Although Super Dry supplies have already been restored, other products, such as non-alcoholic beer and Maruef, are still out of stock.

Rivals such as Kirin, Suntory, and Sapporo Breweries are also seizing this opportunity, and are working through wholesalers to encourage customers to switch from Asahi to their own beer dispensers and glasses. Once these equipment is switched to other manufacturers, it will be difficult to switch back to Asahi even if supplies resume. Ewan McLeish, an analyst at market research firm Sanford C. Bernstein Japan, predicts that Sapporo Breweries will be the biggest beneficiary of this series of disruptions.

According to Nikkei point-of-sale data (POS data) , the top spot in the beer retail market has already shifted from Asahi Breweries to Kirin. Kirin is adjusting shipments of some commercial products to ensure a stable supply of its mainstay products in response to increased demand. Suntory is also adjusting shipments to meet higher-than-expected demand, and Sapporo Breweries has announced that it has increased production of its flagship Black Label and Yebisu Beer .

Related Posts: