China expands rare earth export restrictions, tightening restrictions on materials such as hard drives for national security reasons, posing a risk to PC component supplies

The Chinese government has expanded export controls on

China expands rare-earth export controls, creating risks for PC component supply — Beijing tightens grip on materials for HDDs and more to protect national security | Tom's Hardware

https://www.tomshardware.com/tech-industry/china-expands-rare-earth-export-controls

China unveils sweeping rare-earth export controls to protect 'national security'

https://www.ft.com/content/c4b2c5d9-c82f-401e-b763-bc9581019cb7

China tightens export controls on rare-earth minerals once again | TechCrunch

https://techcrunch.com/2025/10/09/china-tightens-export-controls-on-rare-earth-minerals-once-again/

China Tightens Grip on Rare Earths Ahead of Expected Trump-Xi Meeting - WSJ

https://www.wsj.com/economy/trade/china-imposes-new-controls-over-rare-earth-exports-35a4b106

Shares of rare earths mines rise after China tightens export controls | Reuters

https://www.reuters.com/world/china/shares-rare-earths-miners-rise-after-china-tightens-export-controls-2025-10-09/

In response to the US restrictions on semiconductor exports to China , the Chinese government has announced that it will ban the export of rare earth elements, such as gallium, germanium, and antimony, to the US in December 2024, which are used in the manufacture of weapons and semiconductors.

China bans exports of key minerals used in semiconductors and batteries to the US, as a countermeasure against US tightening semiconductor regulations to prevent military use - GIGAZINE

In April 2025, additional rare earth elements, such as samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium, were placed under export control . Following this, China's Ministry of Commerce announced that it would expand export controls on rare earth elements, citing 'national security imperatives.' As a result, holmium, thulium, erbium, and ytterbium will now be subject to export controls.

The new regulations also require foreign companies exporting products that use even a small amount of rare earth mining technology to apply for an export license from government authorities. This means that foreign companies will need permission from the authorities to export 'magnets containing trace amounts of rare earths produced in China' or 'magnets manufactured using Chinese manufacturing methods.' While export licenses will not be granted to defense organizations, they will be granted to organizations that use rare earths in semiconductor manufacturing based on individual review. Export licenses will not be required for exports for humanitarian assistance purposes, such as public health emergencies and disaster relief.

China is the world's largest supplier of rare earths, so restricting exports of rare earths could affect the production of PC-related products such as hard drives, technology media Tom's Hardware points out.

For example, high-density hard disk drives use

Displays could also be affected. LED backlights and LCD panels use phosphor compounds containing rare earth elements such as europium, terbium, and yttrium to achieve vibrant colors. Both europium and terbium are subject to new export restrictions, which could mean dozens of items used in the display supply chain require export licenses. If this happens, display manufacturers could find themselves in a difficult position, Tom's Hardware points out.

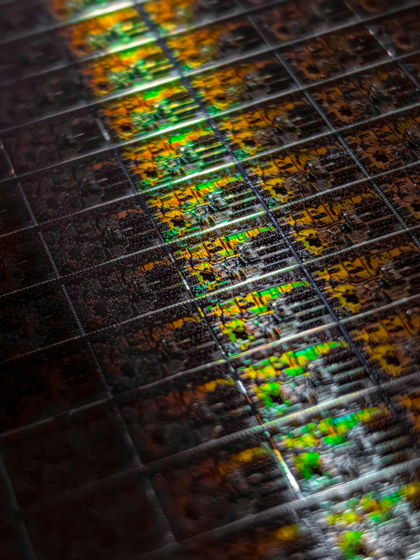

If export restrictions are extended to recycling and processing equipment, they could also have a negative impact on silicon. This is because cerium oxide slurry is used to polish and glass silicon wafers. While it's not a major material, it plays a critical role in the production flow of semiconductor fabs and panel assembly lines. Therefore, delays in obtaining licenses or price fluctuations 'would almost inevitably lead to delays in component manufacturing,' Tom's Hardware noted.

While these products won't suddenly become more expensive tomorrow, 'they do increase the likelihood of unexpected friction in often-overlooked parts of the supply chain. Magnets and phosphors are nothing new, but they are extremely difficult to replace. In April 2025, Western Digital, a hard drive manufacturer, launched a program to recover rare earth elements from used drives, a move designed to prepare for export restrictions like these,' Tom's Hardware writes.

Related Posts:

in Note, Posted by logu_ii