I applied for an EIN (taxpayer identification number) for my business to receive revenue from Google and X.

If you distribute content or earn advertising revenue through Google or X (formerly Twitter), you are earning revenue from a US company, and therefore a 30% US withholding tax is deducted. Companies and sole proprietors residing outside the US must apply for

Applying for a U.S. EIN for Corporations and Non-Individual Entities

https://kdp.amazon.co.jp/ja_JP/help/topic/G201622280

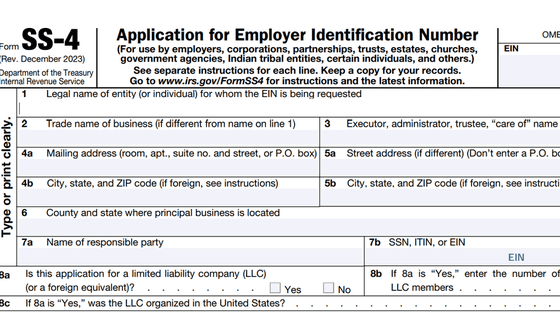

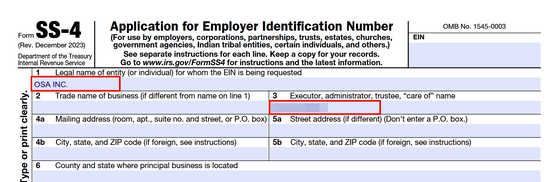

First, download the documents required to apply for an EIN. From Amazon's Kindle Direct Publishing page, click 'IRS Form SS-4 'Application for Employer Identification Number'' to open an editable PDF file.

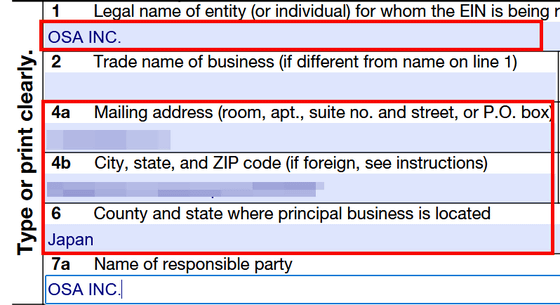

First, enter the information for the organization or individual seeking an EIN. Enter the name of the company or individual in '1' and the name of the representative in '3.'

Enter your location in '4a' and '4b' and 'Japan' in '6'.

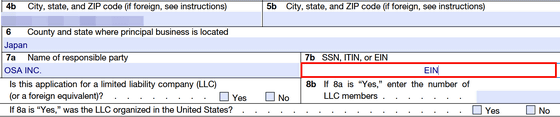

Enter 'EIN' in '7b'.

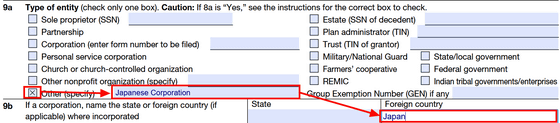

Next, select 'Other' in '9a' and enter 'Japanese Corporation', then enter 'Japan' in 'Foreign country' in '9b'.

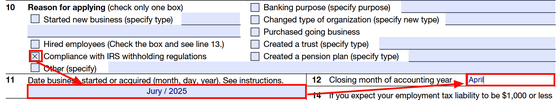

'10' is the reason for applying for an EIN, so check 'Compliance with IRS withholding regulations.' '11' is the timing of starting the business related to the EIN, and '12' is the fiscal year end.

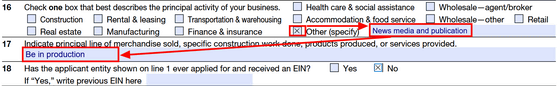

'16' is the type of business, and in this case, I selected 'Other' and entered a specific description. '17' is the name of the product or service you primarily handle, but since business related to the EIN will be conducted after receiving the EIN, it is OK to write 'Be in production.'

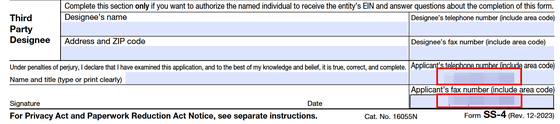

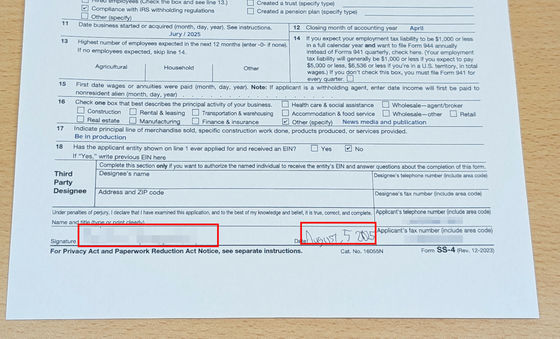

Enter your phone number and fax number in the bottom right corner of the form. You will need to include Japan's country code, '(+81).'

Once you've finished filling out the form, print it out and handwrite your 'Signature' and 'Date.' Scan the form again and fax it to (+1) 304-707-9471, or mail it to Internal Revenue Service Attn: EIN International Operation Philadelphia, PA 19255. If you mail it, it will take some time for the document to arrive. You can also send it via fax at a convenience store and receive a reply by mail. In this case, I faxed it and received the document by mail.

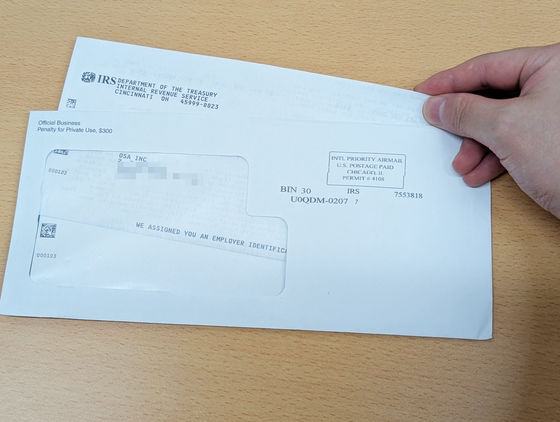

The fax was sent on June 16, 2025, and the envelope arrived from the IRS about two months later on August 7.

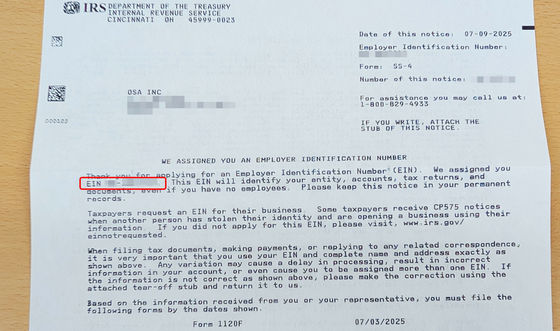

The document contained a nine-digit EIN number: 'EIN ○○-○○○○○○○.' By entering this number as tax information for each service, you can avoid US tax. The completion date listed on the document was July 9, 2025.

In this case, I sent it by fax and received it by mail. It took about three weeks from application to completion of the procedures listed on the documents, and about one month for the envelope to arrive. If you send and receive only by fax, they usually respond within four business days. You can also get your EIN immediately by calling their helpline number, +1(267)941-1099, which is only available Monday through Friday.

According to the website below, if you communicate verbally, a Japanese interpreter will be provided.

[EIN Acquisition] Introducing the options and advantages and disadvantages along with real-life examples | Sakai Research Institute

target='_blank'>https://docs.sakai-sc.co.jp/article/programing/get-ein.html

The IRS office is on the East Coast of the United States, which is 10 hours behind Japan (please note that there may be a difference due to daylight saving time). You will need to call after 11:00 PM.

Depending on the situation, you may have to wait for 1 to 1.5 hours while waiting in line. It's the middle of the night, so you'll be sleepy and your English might be a little stressful. Be patient and wait.

The staff at the counter are English speakers. If you are not good at English, we will do our best to explain that you would like to obtain an EIN number and that you need a Japanese interpreter.

In my case, Excuse me, I would like to get an EIN number. Can I talk with Japanese?

'Translator?' I said. (I'm not good at English, but I was able to understand. Japanese

It will be easier to understand if you emphasize the word 'translator' when you speak.)

The interpreter was probably not a native Japanese speaker, but we were able to communicate without any problems.

You will be asked to fill out the SS-4 form one by one in Japanese. You will also be asked to spell each word, so it will take some time.

Once everything is complete, you will be given your EIN number and told that a notice will be mailed to you in one month, that you should keep the notice forever, and that you should use a copy if you need to submit it.

Now you have your EIN number. The number starts with 98. Be sure to double-check if you have any concerns so you don't miss anything.

Related Posts:

in Web Service, Posted by log1e_dh