Tesla announces second-quarter 2025 financial results, with dismal results of 12% decrease in sales, 14% decrease in vehicle shipments, and 42% decrease in operating profit

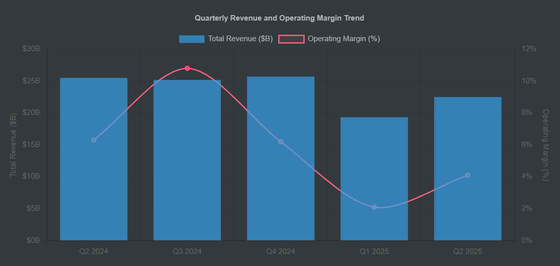

On July 24, 2025 local time, Tesla announced its financial results for the second quarter (April to June) of 2025. Sales for the same period were down 12% year-on-year to $22.5 billion (approximately 3.29 trillion yen), and net income was down 16% year-on-year to $1.17 billion (approximately 171 billion yen).

Q2 2025 Update

(PDF file)

Tesla's earnings hit a new low, with largest revenue drop in years | The Verge

https://www.theverge.com/news/712256/tesla-earnings-q2-2025-revenue-profit-elon-musk

Tesla's Q2 Revenue Drops 12% Amid Margin Squeeze, Pivots to AI Future - SignalBloom AI

https://www.signalbloom.ai/news/TSLA/teslas-q2-revenue-drops-12-amid-margin-squeeze-pivots-to-ai-future

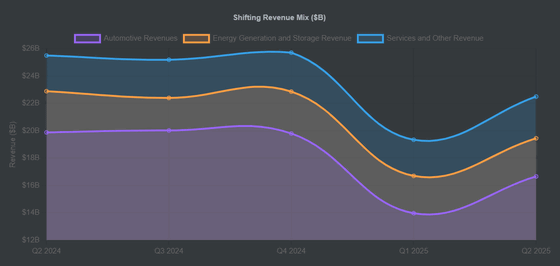

According to Tesla's second quarter 2025 financial results, the company's sales were $22.5 billion, down 11.8% from the same period last year, of which automotive sales (sales from car sales) were $16.6 billion (approximately 2.42 trillion yen), down 16.2% from the same period last year, and regulatory credit business sales were $439 million (approximately 64 billion yen). Total shipments of Tesla vehicles were recorded at 384,122 units, down 14% from the same period last year. The regulatory credit business is a business that sells credits to clear emission regulations and ZEV regulations . The regulatory credit business has supported Tesla's finances, but it will soon end as Republican lawmakers approved President Donald Trump's plan to eliminate fines for automakers that exceed fuel efficiency targets.

Net income was down 16% year-on-year to $1.17 billion, and operating income was down 42% year-on-year to less than $1 billion (about 146 billion yen). Operating income has already fallen 42% year-on-year, but considering that about half of this is from the regulatory credit business, technology media The Verge points out that Tesla may face further difficulties in the future.

Below is a graph summarizing Tesla's quarterly sales (blue) and operating profit (red).

The graph below shows the transition of the percentage of each division in Tesla's sales. Automobile sales are in purple, power generation sales are in orange, and services and other sales are in blue. It is clear that the decline in automobile sales has had a significant impact on Tesla's sales decline.

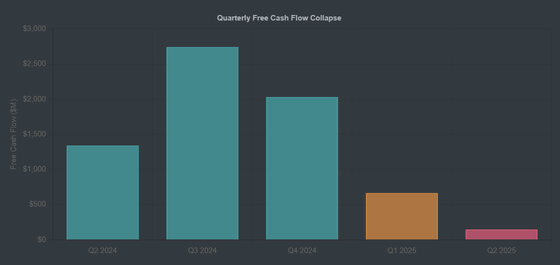

Below is a graph showing Tesla's quarterly free cash flow.

Tesla said in its earnings report that it plans to complete initial production of a more affordable model in June and begin mass production in the second half of 2025, suggesting that sales in the automotive division may improve in the future. The 'more affordable model' is expected to be a simplified version of the Model 3 and Model Y.

Related Posts:

in Vehicle, Posted by logu_ii