Survey of 75,000 smartphone apps reveals the compelling reasons why apps pressure users to subscribe; monthly revenue of $1,000 is too tough

In-app subscription billing management service RevenueCat released a report tracking more than 75,000 apps and over $10 billion in revenue, revealing the compelling reasons why apps pressure users into signing up for monthly paid subscription plans.

State of Subscription Apps 2025 – RevenueCat

Sobering revenue stats of 70K mobile apps show why devs beg for subscriptions - Ars Technica

https://arstechnica.com/gadgets/2025/03/sobering-revenue-stats-of-70k-mobile-apps-show-why-devs-beg-for-subscriptions/

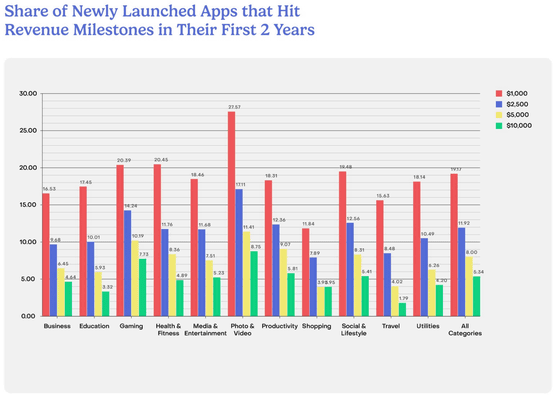

According to RevenueCat, about 20-25% of apps achieve monthly revenue of $1,000 (about 150,000 yen) within two years of release, and about 5% of apps exceed monthly revenue of $10,000 (about 1.5 million yen). The app categories with the lowest percentage of apps (red) that exceeded the $1,000 level in revenue in the first two years of release were shopping, travel, and utility-related. In contrast, the categories with the highest percentage of apps that exceeded the $1,000 level in monthly revenue in the first two years were photo, video, and games.

Also, as shown in the chart below, compared to apps that achieved $1,000 in monthly revenue over two years, only about half achieved $2,500 in monthly revenue, and even half of those achieved $5,000 in monthly revenue, and even half again achieved $10,000 in monthly revenue. RevenueCat concludes that 'there are challenges to sustainable growth.'

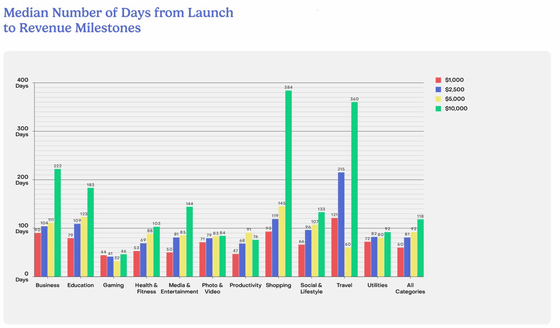

RevenueCat's analysis of apps that surpassed $1000 in monthly revenue found that the average number of days it took an app to reach $1000 in monthly revenue was 60 days. However, as the chart below shows, this statistic varies by app category. For example, education-related apps took 79 days on average, while shopping took 90 days and travel took 121 days, making the loftier goal of $10,000 in monthly revenue more difficult to achieve.

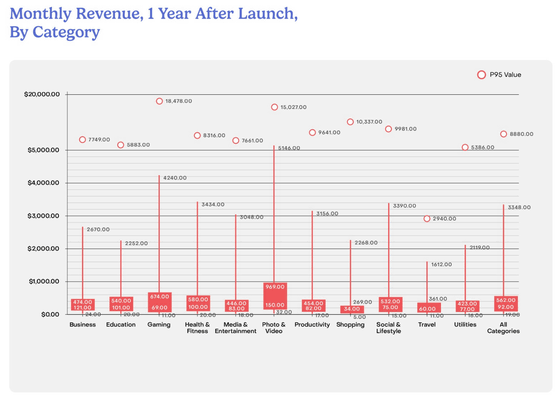

We also found that in most app categories, the revenue gap between the top 5% of apps and the remaining 95% is widening. According to RevenueCat, the top 5% of apps are earning about 500 times more revenue than the remaining 95%. Below is

Additionally, RevenueCat points out that 76.1% of North American developers earn more than 80% of their revenue from iOS apps, creating an imbalance in app monetization.

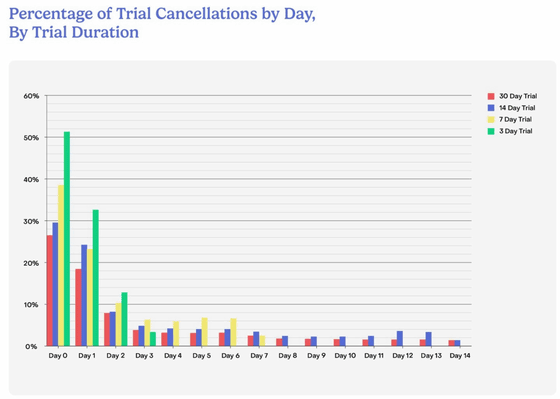

In recent years, more and more subscription plans are being offered as free trials for a set period of time. According to RevenueCat, people are most likely to try out a mobile app subscription plan for a short period of time, with 82% of trials starting on the same day the app is installed.

The graph below shows how many days after a trial, users stopped using the subscription plan. Most users canceled within the first three days of every trial.

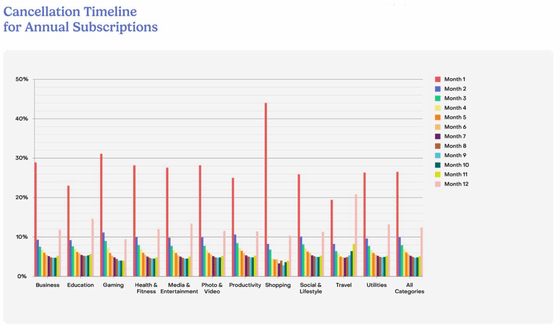

Below is a graph that shows the time it takes for users to cancel their subscription plans by app category. Nearly 30% of users in every category cancel their subscription plans within one month, but for shopping-related apps, more than 40% cancel within one month.

According to RevenueCat, only 10% of monthly subscribers stay on for a second year, and less than 5% of weekly subscribers stay on for more than six months. The lack of price increases as a reason for cancellations suggests that price changes to subscription plans do not have a significant impact on subscriber retention.

'Over the next year, all app categories will likely increase subscription prices to overcome the monetization challenges that mobile apps face,' RevenueCat vice president of growth Rick Hendrickman told Ars Technica.

Related Posts:

in Mobile, Software, Web Service, Posted by log1i_yk