It is pointed out that the sudden rise in egg prices in the United States is due to 'monopoly by a small number of companies' rather than 'bird flu'

US Investigates Egg Producers Over Soaring Prices - The New York Times

https://www.nytimes.com/2025/03/07/business/us-egg-prices-investigation.html

Farm Action Calls for an Investigation into Skyrocketing Egg Prices and Restricted Supply | Farm Action

https://farmaction.us/farm-action-calls-for-an-investigation-into-skyrocketing-egg-prices-and-restricted-supply/

Hatching a Conspiracy: A BIG Investigation into Egg Prices

https://www.thebignewsletter.com/p/hatching-a-conspiracy-a-big-investigation

The rise in egg prices in the United States is quite serious. For example, the wholesale price of large grade A eggs was $0.50 to $1.30 per dozen in 2021, but has risen to $6.00 to $8.00 per dozen in 2025.

Bird flu is spreading in the United States just as it is in Japan, and egg producers explain that 'the mass deaths of chickens due to bird flu are causing the price of eggs to soar.' However, Farm Action , an organization working to make competition in agriculture fair, points out that 'bird flu has only had a small impact on egg production, and the monopoly of the egg market by a small number of companies is causing the price to soar.'

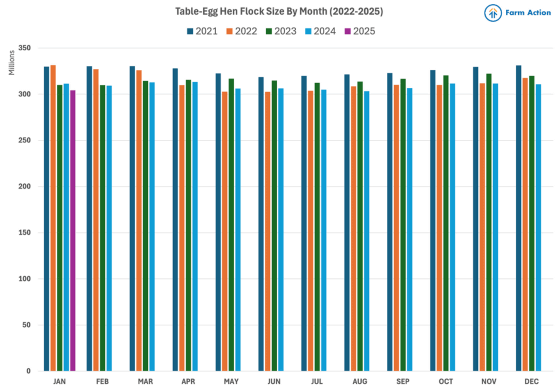

The graph below shows the number of egg-laying hens raised in the United States by month, with blue in 2021, orange in 2022, green in 2023, light blue in 2024, and purple in 2025. The number of hens raised in 2024 is 5.18% lower on average than in 2021, but this is not a rate of decline that would cause prices to rise. In addition, production by Cal-Maine Foods, the largest egg producer in the United States, will remain stable at 1.1 billion dozen per year from 2021 to 2024.

Amid rising egg prices, Cal-Maine Foods' gross margins are growing 237% from 2021 to 2024. If you narrow the time frame to 2021 to 2023, gross margins are up 646%.

Major egg producers, including Cal-Maine Foods, are spending their profits to increase their market power without returning them to prices. For example, Cal-Maine Foods acquired Fassio Egg Farms in 2023, and major egg producer Daybreak Foods also acquired Hen Haven LLC and Schipper Eggs in 2023. The market share of the top five egg producers in the United States was 37% in 2023, but after a series of acquisition transactions, it will expand its share to 46% in 2025.

Farm Action has pointed out that the monopoly situation described above is stifling price competition and causing egg prices to soar, and has sent a letter to the Federal Trade Commission and the Department of Justice calling for an investigation. The full letter can be found at the following link.

Final_FarmAction_FTC_DOJ_EggPricesLetter.pdf

(PDF file) https://farmaction.us/wp-content/uploads/2025/02/Final_FarmAction_FTC_DOJ_EggPricesLetter.pdf

Related Posts: