What will happen if we compare the income obtained when employing a job in a university graduate and the income earned when employing a high school graduate and turning into university's tuition fee?

ByCollegeDegrees 360

The income that can be obtained differs between cases where you graduate from high school and you get jobs right away, and cases where you get a job after graduating from college. In terms of lifetime income, generally there is data that university graduates are more advantageous (higher) than high school graduates, but in practice the tuition (investment) paid when they passed the university for four years, Erik Rood, an analyst at Google, calculates and reveals how much profit it will generate over the next 20 years, and that ROI (return on investment) is calculated by Google.

College ROI

http://erikrood.com/Posts/college_roi_.html

Mr. Rood divides life's choices into "A" and "B" and simulates each scenario.

A choice of life A says, "I go to work without going to college and pay money that was supposed to go out as a tuition fee to investment." Of course, it is extremely unlikely that large loans will be given to young people, such as "I would like to invest the tuition fee that did not go to university in the stock market", so Mr. Rood warns that it is a "hypothesis" to the last .

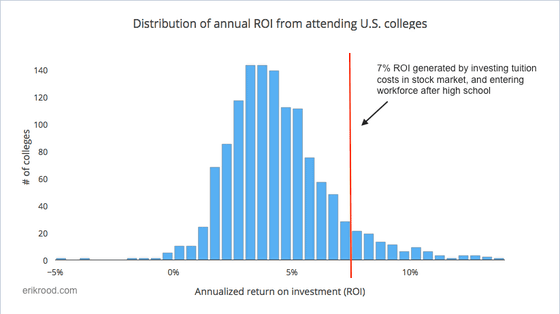

It is the representative stock index of the United StatesS & P 500Was 435 at the beginning of 1993, but it increased to 2260 in 2017. Twenty-four years' worth is the sum of twenty years plus four years that did not go to university, total return is 520%. ROI per year is 7.1%.

Life option B is "go to college, pay tuition fees, graduate and aim for higher income".PayScale College ROI ReportBy using the data of 4 years' tuition and wages obtained in 20 years, the expected ROI was calculated taking into account the graduation rate, which was about 4.5% (median 4.1%) on average.

In other words, in the assumption of graduation in 2017, it can be said that the profit was greater in option A (high school graduate + investment) of life than choosing life choice B (university graduate).

Among the universities listed in Payscale, ROI exceeds 7.1% is about 10%. The bar graph created by Mr. Erik Rood is an array of ROIs for each university, with the place below 5% being the largest mountain. The red line is drawn is 7.1%, which is the ROI when investing money with high school graduates, so if you do not go to the right from here, it means that "ROI was lower for university graduates" .

The data on university graduates included scholarships, and on the condition of "Without scholarships", the number of universities that got higher ROI than high school graduates + investment was less than 2.5%.

By the way, Mr. Erik Rood himself who made the data himself scenario is based on the assumption and commented "I recommend going to the university like my own."

Related Posts:

in Note, Posted by logc_nt